simpego Car M

The basics

Insured amount:

CHF 100 million

Deductible for undeclared drivers under the age of 25:

+ CHF 1,000

Glass Plus (small glass parts):

Not insured

Items that individuals take with them:

Not insured

Parking damage cover:

Not insured

Parking damage cover deductible:

Not insured

Deductible for undeclared drivers under the age of 25

+ CHF 1,000

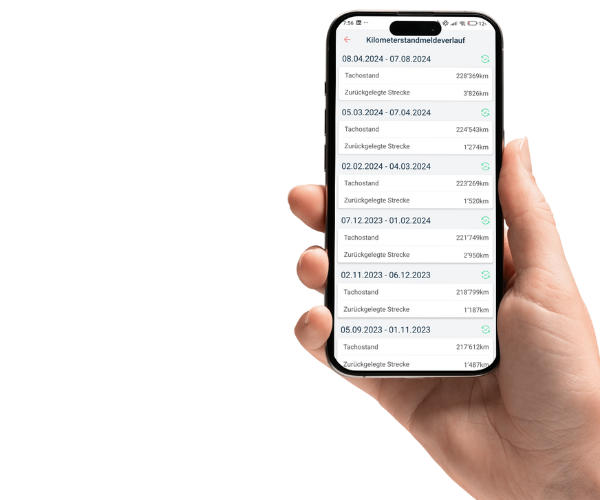

Partner garage

FlexDrive